How you can beat rising mortgage rates in 2022

Interest rates are set to rise in 2022. Mortgage borrowing costs may jump over 23% by year’s end. The good news: home buyers and sellers should have time to beat the projected rise in rates!

Quick overview

The Federal Reserve is expected to raise short-term interest rates a total of 75 basis points (0.75%) in 2022. The rate rise may take place via a series of three 25 basis point (0.25%) increases spread over the course of 2022, with the first uptick occurring potentially as early as this spring.

Mortgage loan rates are expected to follow overall interest rates higher. Because mortgage rates are currently so low, even a minor rate rise will significantly increase mortgage carrying costs for home buyers. By year’s end, home buyers could face what amounts to a whopping 23% increase in mortgage borrowing costs.

If you’re planning to buy and/or sell a home in 2022, you should consider accelerating the timing of your transactions to avoid, or at least lessen, the negative impacts of rising mortgage rates later in the year.

Fed expected to raise rates to fight inflation

The US Federal Reserve recently announced an important change in its interest rate policy. The Fed signaled that it will begin tightening credit in 2022 in order to restrain inflation.

As described in many news reports, including the ones summarized in the download here or via the hotlink in the image above, the Fed is expected to raise short-term interest rates a total of 75 basis points (0.75%) before the end of 2022.

The rate increases may begin as early as next spring. They may take place in a series of 25 basis point (0.25%) increments spread throughout the year.

Mortgage rates would follow suit

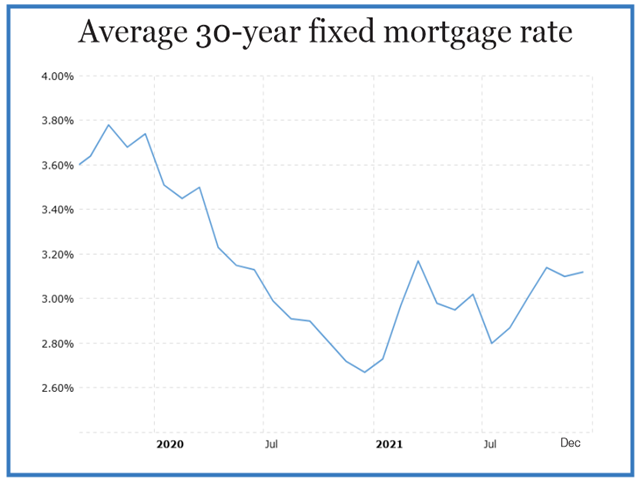

While the Fed no longer directly sets long term interest rates, it generally is expected that overall interest rates will follow short term rates higher. This means that mortgage interest rates could be on the rise in 2022.

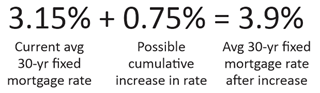

As you can see in the above chart, the average 30-year fixed mortgage rate is extremely low, currently at about 3.15%. If this average were to move 75 basis points higher by the end of 2022, the average 30-year fixed rate would stand at 3.9%. At 3.9%, the average 30-year fixed mortgage rate would be just a bit higher than where it was at the end of 2019.

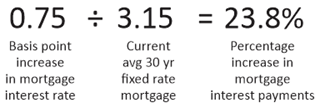

A 23% rise in home buyers’ mortgage interest payments

A 75 basis point rise would be a minor increase in absolute terms. But because any rise in mortgage rates in 2022 will start from such a very low base – current mortgage rates are near historic lows – an increase on a percentage basis will be large and would have a significant impact on borrowers’ mortgage interest payments.

What this means for home buyers

For prospective home buyers, a 75 basis point rise in mortgage rates by the end of 2022 would mean that your mortgage debt service payments on the home you buy late in 2022 would be over 23% higher than what your payments would be on a home you purchased today. That’s a sizable increase in mortgage carrying costs!

Prospective home buyers would be wise to play it safe and accelerate your 2022 home purchase plans, if at all possible. You should try to secure a home early in 2022 to beat the expected rise in rates.

What this means for home sellers

For prospective home sellers, a 23% increase in buyers’ mortgage costs would reduce the number of buyers who can qualify to purchase your home. And that could put downwards pressure on the selling price of your property later in 2022.

Home sellers would be smart to get their properties on the market earlier in 2022 rather than later. Why delay and take the risk of rising rates putting downwards pressure on home prices later in 2022?

Full article available

The above is an excerpt from our full article on the outlook for rising rates in 2022. You can access the full article here.

Next steps for home buyers

A good real estate agent can remove much of the stress and uncertainty from the home search process. From setting goals to securing a loan to selecting the best neighborhood to meet your needs, we will be there to assist you every step of the way.

And no one has more access to home listings, past sales data, or market statistics than a professional agent. We can set up a customized search that alerts you as soon as a new listing you might like goes live. Better yet, we get notified about many of the hottest homes even BEFORE they hit the market.

It’s never too early (or too late) to contact an agent about buying a home. Whether you plan to buy today, next month, or next year, there are steps you can (and should) be taking to prepare for your purchase.

Contact us or give us a call/text at 508-561-6259 today – no obligation!

Next steps for home sellers

Determining a home’s true market value is a real estate agent’s forte. If you’re a seller, your agent will help you find your home’s market value so you can list it at the right price.

Curious about your home’s true market value? Use the link to request a free, no-obligation Comparative Market Analysis to find out exactly how much your home is worth!

We’d love an opportunity to win your business. Schedule a free consultation with us to find out how true market experts can help you achieve your real estate goals – call/text us at 508-561-6259. We’re here to help!